Edmund Burke“Society …is…a partnership …between those who are living, those who are dead, and those who are to be born.”¹

Paul Krugman“Productivity is not everything, but in the long run it is almost everything.”²

John Maynard Keynes“In the long run, we are all dead.”³

Productivity, budget sustainability and economic resilience are all centrally important to the prosperity of Australians living after today. They are also essential to the continuity of the democracy that has worked well for Australians but can’t be taken for granted.

Krugman reminds us of the ultimately binding productivity constraint on living standards. Keynes reminds us that what happens in the future-defining years before we get to the long run also matters.

Productivity, budget sustainability and resilience mainly affect people living in future. They matter for Australians because most of us, like Burke, value the lives of future generations, even if most of our own lives are in the past. We can add climate change to productivity, budget sustainability and resilience as the big economic issues connecting the generations. Climate change is in the inter-generational mix even if we don’t make explicit reference to it: how we manage climate change and the energy transition has large effects on all of productivity, budget sustainability and economic resilience.

The context of Keynes’ remark shows that his concern for the not-so-long-run was motivated by concern for the quality of the lives of people who lived after him. He grew up with and lived within Burke’s values. His famous statement was made during Europe’s economic disruption, unemployment and poverty after World War I. Unless the world’s leaders brought the misery to an early end, the prospects for European prosperity, democracy and peace would die.

Krugman’s famous remark is true, but the long run is many decades and not quarters or years. German economic historian Friedrich Engels observed in 1845 that productivity grew strongly in the first half century of the English industrial revolution, but living standards of workers stagnated and fell.⁴ This is the “Engels Pause” in British economic history. The joining of Engels’ empirical observations to Karl Marx’s extrapolations from classical economics led to The Communist Manifesto in 1848.

Marx and Engels were wrong in anticipating a continuing divergence of productivity from living standards. They missed the rise of democracy and its capacity to modify the distributional consequences of industrial growth.

Democracy in the US is now threatened by a new and similarly consequential Pause in ordinary people’s living standards through a period of moderate productivity growth: the stagnation in real wages and living standards since 1980. This “US Pause” paved the path to President Trump and the disruption of US economic life, democracy and leadership of a rules-based international order.

Australia did not experience the US Pause in the three decades after 1980. The productivity-raising and budget-consolidating reform within an effective social democratic framework from 1983 put us on a very different path. Australian productivity and general living standards rose at the highest rate in the developed world in the 1990s. Recession was avoided through the Asian and global financial crises. Ordinary Australians’ incomes continued to rise strongly through the first dozen years of the twenty first century as a more productive economy utilised trade opportunities in the China resources boom.

But let’s not kid ourselves about the severity of our current problems. Real wages and living standards hardly grew at all in the 9 years from 2013 until the election of the Albanese Labor Government in 2022. Unlike the Engels and US Pauses, this was not only a pause in rising living standards, but a near-pause in productivity growth as well. So far as we can tell from the data, ordinary Australians’ real wages had never before stagnated so badly over a comparable period. Real wages and living standards are now lower than in 2022. Without big changes, the 9 years forward from 2022 may be worse than the 9 years they follow. There will be unhappy consequences unless we decisively change the trajectory.

We face strong headwinds in restoring productivity growth. The Trump-led breakdown of the open global trading system damages Australia as much as any other developed country except Canada despite our own exports to the US being relatively unimportant. The disruption of economic life in Australia from real existing climate change and the decline of two of our three largest export industries as other countries reduce carbon emissions are headwinds. There is a gale in our faces from an energy system in which official discretion increasingly plays an important role in every investment decision, and as private business decisions in markets are pushed to the margins. And the changes in our political economy that have given us stagnation in productivity and living standards over the past dozen years will block our path forward until we stare them down.⁵

Our budget outlook is daunting at a time when budgetary strength is required for protection from external shocks. Slow productivity growth damages the budget. Government deficits in the developed world led by the United States threaten to end the historically low real interest rates on public debt. We have been advised of the budgetary costs of ageing since the first inter-generational report from Treasurer Costello early this century. Those who support and those who oppose expenditure under AUKUS agree that defence expenditure will rise by a percentage point of GDP or more. Current estimates suggest inexorable NDIS cost increases.

But Australians also have extraordinarily rich opportunities for correcting the unhappy and dangerous tendencies.⁶ Define the opportunity and move towards its acceptance in the 48th Parliament and we give Australia a chance for a long period of enhanced productivity growth and rising living standards. Fail now, and we lose the best chance we will have for decades.

General Policies and Conditions

A lifetime of observation of economic development in Australia and elsewhere has taught me that three general conditions are especially important to building a long period of rising productivity and living standards. The first is commitment to full employment with moderate and reasonably stable inflation. The second is open, non-discriminatory international trade and investment. The third is separating clearly those things that only government can do (including correcting major market failures) from those in which competition among private entities is most productive; having the government do its own things well; and leaving the rest to private decisions in competitive markets. The third matters a great deal for all of productivity, budget sustainability and resilience.

The Australian authorities’ objectives are now broadly in the right place on the first and second of the general conditions. From 2013 to the pandemic, the Australian authorities mostly ignored full employment and inflation was often below the target range. The direction if not the scale of the mistakes of that period are now widely recognised. On the second, the Government is committed in principle to open trade and investment, although there is some drift away from the objectives in actual policy. We are a long way from the necessary conditions on the third. The greatest opportunities for getting greater value from markets are in energy. I sketch one reform suggestion that would help clear the way for greater use of markets in the important energy sector at the end of this note.

The first of the necessary general conditions, full employment, supports productivity growth in two big ways. It applies pressure on employers to use labour more productively. And it shifts political and policy focus from “jobs, jobs, jobs” (which is inherently negative for productivity) to sustainable growth in wages and living standards.⁷ Full employment is great for the budget. Reducing unemployment from 5 percent (below the average 2013-19) to around 3.5 percent (as it was for about a dozen months without accelerating inflation in 2022 and 2023) raises output by over 2 percent. This strengthens public sector budgets by around 1 percent of GDP, or around $25 billion per annum.

How the authorities get the economy to full employment also matters for productivity and the budget. Relying excessively on fiscal rather than monetary expansion when increased demand is warranted restricts activity in the competitive private sector producing internationally tradeable goods and services, where productivity growth is strongest. Relying on fiscal rather than monetary expansion also increases budget deficits.

On the second of the necessary general conditions, remaining open and non- discriminatory to imports of goods and services and to investment is critically important to productivity growth. Australia has a reasonable recent record, including through avoiding retaliatory increases in trade barriers in response to the Trump increases in protection in breach of the WTO rules and the US-Australia Free Trade Agreement. But our discipline has weakened on some issues over recent years. We have introduced many investment restrictions on security grounds. That’s all to the good if decisions are based on rigorous assessments of the security value involved, and comparisons with economic cost. US former National Security Adviser Jake Sullivan spoke of confining restrictions on trade and investment on security grounds within “small yard, high fence”.⁸ Australia has been building high fences around a large yard for restriction of Chinese investment, often without discussion of the large costs to productivity. And we are slipping without policy discipline into protection against imports that compete with long-established domestic production. Every old metal smelting operation in the country has become a candidate for emergency assistance over recent years, often in response to assertion that Chinese suppliers are “dumping” surplus produce. Yet most relevant international metals prices are higher in real terms now (2024 and 2025) than a decade ago (2015 and 2016).

Clearing the Way for Competitive Markets

Competitive markets generate optimal investment and rising productivity if government interventions are restricted to clearly defined activities in which a government role is necessary for good performance. These include supply of public goods and the services of natural monopolies. They also include correction of market failures resulting from private transactions imposing large costs or conferring large benefits on firms or people outside the transaction. The corrections of market failures will be effective only if they are undertaken within stable rules known to market participants in advance of investment.

The August Roundtable will pay attention to over-regulation as a barrier to higher productivity. Defining clearly the boundary between the role of the state and the role of the market is the starting point for avoiding unnecessary, costly regulation.

The recent draft Productivity Commission report on net zero explains that the costs of the energy transition will be lower if government interventions cause investment and production decisions to be closer to those that would be made in response to an economy-wide carbon price.⁹ They incidentally reveal that decisions don’t get close to those outcomes without a carbon price. The Commission draft report shows without stating that the uncertainty and high costs of myriad interventions cannot be avoided without a carbon price. The draft of the Nelson wholesale energy market review notes correctly that uncertainty discourages investment and the resulting low investment encourages new interventions, which bring more uncertainty. That is the world of the contemporary Australian energy sector.¹⁰

Energy is important to performance in all sectors of the economy. And over the next several decades it is fundamentally important to Australia’s prospects for maintaining strong growth in total exports in line with comparative advantage (itself important for productivity growth) as coal and gas exports decline. Two recent papers from The Superpower Institute demonstrate that the new export industries can be many times larger than the industries that will decline with the phasing out of fossil carbon.¹¹

If Australia uses its opportunities for productivity growth and prosperity well, by mid-century electricity supply to the new industries will be many times larger than total current electricity supply and use. The timing, scale, location and technology that will minimise costs and risks for the new industries are highly uncertain. We, and participants in markets, will learn about them as the shape of the emerging zero-carbon world economy reveals itself.

Much of the new electricity demand will come from electrolysers producing hydrogen, which are highly flexible in their use of power. Hydrogen will be used for its chemical properties and only at the margins as an energy source—for example, reducing iron ore to metal; and bonding with sustainably grown and harvested biomass to produce green transport fuels.

State and Markets in the Energy Sector

What must government do in the energy sector? It must take responsibility for security and reliability of the power system, and for the natural monopoly infrastructure for electricity and hydrogen transportation and storage. And it must correct large market failures related to the external costs of carbon emissions and external benefits of innovation in zero-carbon production.

We are all aware of the challenges in transmission planning and investment.

The security record is a good one under current arrangements. AEMO is adjusting to the challenges of a grid with much decentralised generation and mainly intermittent renewable energy sources. There is more to be done with growing requirements for additional grid services, as discussed in the draft Nelson Report.

Reliability is a special challenge. Arbitrage through the market is unlikely to justify keeping generation capacity available to cover the last metre of reliability in the face of all possible threats to it. The solution is in an understated suggestion from the Nelson Committee’s draft report: establish a new longer-term out of market reserves service to cover high-impact, low-likelihood events. With flexible hydrogen electrolyser capacity much greater than the old demand for power in the grid, this will probably become by far the lowest-cost source of long-duration reliability services. Will any, and how much, gas peaking be able to compete with hydrogen flexibility? Will long-duration battery and pumped hydro storage be able to compete? Some. How much? We will learn as we go along. The answer would come from two sources. First, an unfettered market matching power supply and demand up to a high specified price.¹² Second, a well-resourced government agency with a clear mission to provide last-resort reliability services to clear the market at some specified high price, at the minimum cost.

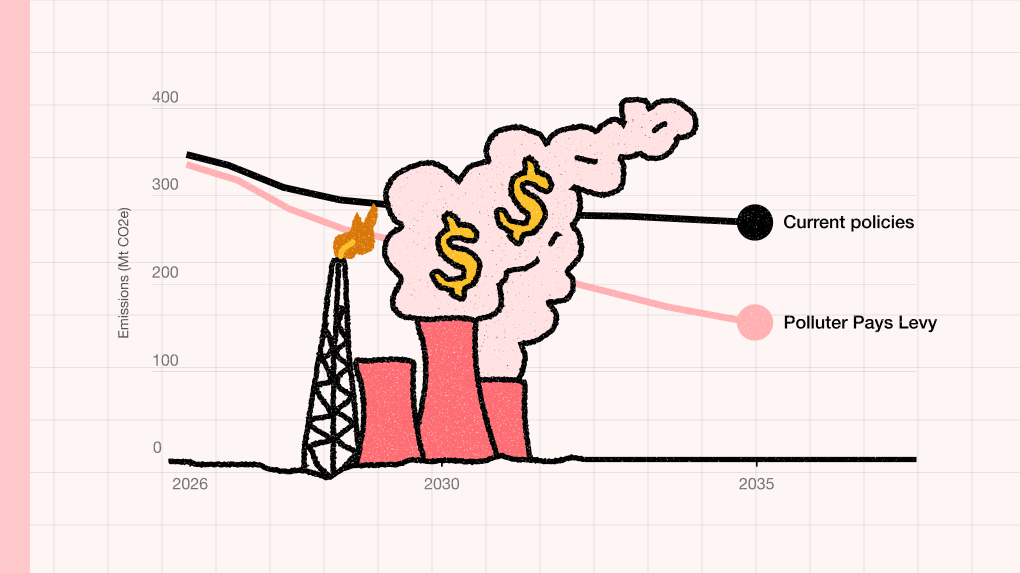

The Government’s most important role as we move to net zero by 2050 is to correct the market failure associated with the damage a firm imposes on others when it emits climate-changing gases into the atmosphere. Lord Nicholas Stern described the emission of gases that damage other businesses and households as the biggest market failure in history.¹³ With the Renewable Energy Target (RET) winding down, the Government has withdrawn from the field of systematically correcting for the greatest market failure ever known. Politics, like nature, hates a vacuum. The void is being filled by myriad costly interventions, with incomplete coverage, widely varying costs of reducing emissions, ever-changing rules and parameters, and the complete cessation of private investment in solar and wind generation that is not underwritten or supported case-by-case by government. This is building immense contingent budgetary liabilities, the dimensions of which are unknown to the public, and by the nature of things imperfectly known to the fiscal authorities themselves. The measures announced to date with their large budget commitments are unlikely to get us close to the target of 82 percent renewable electricity by 2030, let alone the stronger targets that are required after that.

The unusual structure of the electricity wholesale market has obscured the inadequacy of incentives for investment in renewables generation. Solar and wind generation have much lower long-run costs of production than coal and gas generation. Why, then, is it necessary to correct for the carbon externality, if the objective is to replace coal and gas energy by zero-carbon alternatives?

Two charts from my speech to the Clean Energy Council Summit in late July help us to understand why.¹⁴ The average wholesale energy price tends to be very low when the sun is shining and the wind blowing and very high at other times. A number of developments over the past two years have undermined the value of renewable energy certificates within the RET. So the average total revenue received from sales of solar and wind electricity is very low—solar only one fifth of gas in 2024-5. It is much lower still in 2025-6 as it is emerging, with much lower prices for RET certificates. The average price received by coal and gas generators—the average of when the sun is shining and wind is blowing and when they are not—is much higher than it has ever been. Gas power receives much higher average prices than ever before, even though gas commodity prices are much lower than 2 and 3 years ago. Average prices paid by power users are lower the more solar and wind enters the system. But there is no market incentive in the wholesale price of power alone to justify new private investment in solar or wind. Nor is there any incentive for coal and gas power to cease production for as long as established plants are capable of continued operation (although uncertainty about the future inhibits investment in new capacity or refurbishment). The outcome is damaging shortfalls in power supply alongside hopeless failure on emissions targets in the absence of policy reform.

Doesn’t the low value of solar and wind generation at the time when it is available mean that we have enough of them? In truth, we cannot get close to our renewables and emissions targets without an immense expansion of supply from them. And current market arrangements have removed incentives for the market to make the necessary investments. Once there is confidence in the expansion of supply, the energy market provides incentives for investment in the storage and flexible use of power that brings prices when the sun is shining and the wind blowing closer to those at other times.

A green premium restores the necessary incentives. It would bring alive the many wind and solar projects that now have planning and grid connection approvals even within the existing transmission system, but have been put on hold because expected sales revenues do not justify investment. The projects with planning and grid connection approvals that are on hold include an increasing number that have received underwriting commitments from the Commonwealth and state governments.

Without a green premium, private investment in renewable power generation falls, Government intervenes more and more intrusively in an attempt to induce expansion of generation. That increases uncertainty and reduces investment that is not underwritten by Government. It increases current and contingent budget liabilities.

The best solution for productivity, the budget and economic resilience is a carbon price. This is the highest of reform priorities independently of the contribution it makes to achieving renewable energy and emissions reduction targets. Incidentally, it would ensure that we achieve targets that are beyond reach with current policies with current parameters. Applied with the parameters proposed by The Superpower Institute in its submission to the Roundtable, it would substantially reduce contingent public budget liabilities. In addition, applied with an EU-style CBAM, it would directly contribute around $25 billion to budgetary strength after payments to insulate households from any increase in power prices resulting from the change.

A carbon price would allow the market to get to work in raising productivity in the energy sector. It would improve economic resilience by freeing markets to resolve differences in judgements about levels, locations and kinds of energy investments. The resolution would come through the competitive interaction of thousands of participants in markets.

Markets do not make better decisions because the average knowledge or intelligence of all or any of their thousands of participants is greater than that of the highly intelligent and educated bureaucrats in Canberra and the state capitals. They make better decisions under great uncertainty because participants who happen to make the calls that are closest to those that minimise costs expand their influence and those who happen to make predictions that are further from reality as it emerges fall out of the decision-making process. Markets are flexible in response to new information in a highly uncertain world. Official planning systems are not.

The Nelson draft report makes it clear that consideration of carbon pricing was “beyond scope”. Bringing it within scope would greatly increase the value and reduce the cost of the Nelson recommendations. With carbon pricing, a number of measures proposed by the draft report of the Nelson Committee to improve the operation of the market will be more ejective and much less costly to the budget than under current policies.

The productivity advantages of carbon pricing include much more ejective management of uncertainty about demand growth. If we have a system in which thermal generators using gas and coal pay for the damage they impose on others, we can let the market decide how much wind and solar and coal and gas and nuclear power investment is needed to clear demand in a decade or two. Expectations of prices received in future will rise with growing demand from electrification, data centres and Superpower industries. If a central office takes decisions on how much underwriting of new generation investment is required to meet future demand, and underestimates demand, power will not be available to meet the requirements of growing data centres and other new industries. Investment in future industries will grind to a halt. That doesn’t happen when a market with carbon pricing sets incentives for investment. Some market participants will then anticipate increased demand and make money from investing to serve it. The investment will occur in whatever technology is expected to meet the purpose at lowest cost after factoring in the cost of the damage that emissions impose on others.

Introduction of carbon pricing is the most economically efficient tax reform available to Australia at a time when we need budget repair. It is an indirect tax that delivers all of the economic advantages claimed for an increase in GST by its advocates, with the additional advantage of greatly increasing the efficienct of the energy markets.

Carbon pricing in line with the EU has another additional advantage of allowing CBAM-free entry of Australian products into the EU (and the UK and other countries with similar pricing systems). This will encourage our major partners in Northeast Asia to use the European carbon price as a guide, which supports Superpower developments in Australia.

Once carbon pricing at an appropriate rate is in place, there is no case for anyone arguing on climate grounds about whether coal or gas or nuclear or wind or carbon capture and storage is desirable. All forms of energy and all ways of reducing emissions can compete on a level playing field. There is no need then for a climate trigger in environmental legislation. Nuclear power, which is genuinely zero emissions like solar and wind, gets the same advantage on climate grounds as wind or solar. Gas gets an advantage over coal because it does less climate damage. Geological carbon capture and storage is rewarded for its reductions in emissions at the same rate as renewable energy. So is sequestration of carbon in plants and soils.

Carbon pricing cannot be avoided even at very high cost in travelling the last kilometre to net zero. When we get to net zero (by 2050 under current bipartisan policy), there will still be some emissions from industries in which removal is exceptionally costly. These will be balanced by negative emissions from rigorously measured and accounted sequestration of carbon in soils, plants and geological structures. Secure sequestration of carbon that is authoritatively measured and accounted, and profitable at the appropriate price of carbon, will have a role in the economy of the future. The reduction in emissions in the industries in which reduction is most costly, and the sequestration of carbon in nature and geological structures, will both increase as the carbon price rises, until they equal each other at net zero. The progress towards net zero will be uncertain and unnecessarily expensive until the uncertainty about the future carbon price is removed. Since we must introduce carbon pricing sooner or later, best we reduce the total costs of uncertainty by doing it sooner.

Supporting policies would include a payment to households to offset any transitional wholesale power price increases affecting them. This could take the form of continuation of the household payments now being made through the Commonwealth budget, with the amount adjusted for changes in wholesale prices driven by carbon pricing.

Supporting policies could include removal of the fuel excise tax and introduction of road congestion and user charges. Road users that burn petroleum would pay a sum equal to the external carbon costs that their carbon emissions impose on others (zero for electric vehicles using renewable energy), plus the costs of their use of roads. Off-road consumers of petroleum would only pay for the external costs of their carbon emissions. Average payments by off-road petroleum users would be appropriately higher than under current arrangements, but less than if they were subject to the current fuel excise. If there were delays in introduction of road user and congestion charges, the fuel excise would be continued at a lower rate with exemption for off-road users, alongside the carbon price. This would resolve current debates about fuel excise taxes and road user charges in ways that are favourable to productivity and the budget.

Finally, Governments must correct for the market failure from the external benefits that one firm’s innovation provides to others. Appropriate principles are set out in the Treasurer’s paper with the 2024 budget, Future Made in Australia National Interest Framework. The principles are reinforced and parameters suggested for one important Superpower industry in The Superpower Institute’s “A Green iron Plan for Australia”. That is a model for other industries.

Ross Garnaut

Melbourne, 14 August 2025.