I want to make two points today.

The first is that the renewable energy transition is sick.

The second is that there is a known and reliable cure. Apply it now and the patient can be out of bed soon, in good health within a few years, and growing healthily after that.

The Government’s objectives on renewable generation, emissions reduction and building new export industries based on our renewable energy resources are realistic and strongly in the national interest. Failure to reach them will have tragic consequences for Australian productivity, budgetary strength and contribution to the global climate mitigation effort. We are for the time being on a path to comprehensive failure.

This energy transition sickness has four symptoms:

- First, and most fundamentally, Australia is currently on a trajectory to miss its renewable targets because of low investment and output in grid-scale solar and wind. Not by a little, but by a big margin.

- Second, despite getting other preconditions right, progress on Australia becoming the world’s main exporter of zero-carbon energy-intensive goods is being blocked by renewable energy supply in the grid.

- Third, government policy has pushed private decisions based in competitive markets to the margins of power generation investment decisions, removing a source of knowledge and economic dynamism that is essential for achievement of the objectives. There is now almost no new private grid-scale investment in solar and wind generation that is not underwritten by the CIS or by Government through other mechanisms.

- Fourth, we run the risk of spending a national budgetary fortune to buy failure.

The best cure in the national interest is a carbon price. Not by a little bit, but by a big margin. Unutilised large generation certificates (LGCs) from the RET would be credited at an appropriate carbon exchange rate against future carbon price liabilities. I will suggest dosages and means of application in this speech.

The carbon price greatly reduces contingent budget liabilities from the CIS and other underwriting schemes. In addition, it can add about one percent of GDP or about $25 billion to government revenues, with only a small proportion being required to compensate households for increases in power prices.

Introduction of carbon pricing is the most economically efficient tax reform available to Australia at a time when we need budget repair. It delivers all of the economic advantages claimed for increases in an increase in GST by its advocates, with the additional advantage of increasing the efficiency of markets.

The carbon price unleashes the innovation, dynamism and capital resources of competitive markets to build the transition. It efficiently reduces emissions through most of the economy and not only in electricity generation.

The carbon price unleashes the innovation, dynamism and capital resources of competitive markets to build the transition

Get the parameters right with carbon pricing linked to the residual RET certificates, and we can be confident of meeting our 2030 renewable energy targets and be in a strong position to reach post-2030 emissions targets consistent with our commitment to play our part in achieving global net zero by 2050. That provides a renewable energy base upon which other necessary policies can be lain to build the new zero-carbon export industries.

If early movement to carbon pricing for some reason proved to be unattractive, one alternative can provide temporary relief. This is strengthening and extending the Renewable Energy Target. That would allow us to reach our 2030 renewable energy objective, and help to build the energy foundations of the Superpower. It would reduce contingent liabilities of the CIS and other underwriting schemes, but would not make other contributions to the budget. It would restore a major role for private investment in competitive energy generation. It would not contribute to reducing emissions outside electricity. Sooner or later, and well before 2050, it would need to be supplanted by carbon pricing.

Apply neither of the remedies, and we are headed for energy and climate policy crisis within a few years, with demands from the energy sector contributing to severe budgetary problems.

The Shortfall in Solar and Wind Generation

The Abbott Government policies introduced over a decade ago were not meant to reduce emissions much, let alone put us on a path to net zero. Nevertheless, we made significant progress within these policies. The extraordinary quality of Australian renewable energy resources, the strong support for renewable energy and climate change mitigation within the Australian community, the Senate blocking repeal of the Renewable Energy Target in 2014, and now the Herculean efforts of Ministers in the Albanese Government allowed considerable progress for a while. The world-leading boom in battery storage investment is an important positive story that delivers a necessary supplement to greater grid-scale wind and solar generation.

But there are limits to the progress that we can make towards Anthony Albanese objectives using Tony Abbott policies. These policies include the safeguard mechanism and heavy reliance on voluntary commitments to using renewable energy. Australia now needs Anthony Albanese policies to achieve Anthony Albanese objectives.

The central problem now is insufficient investment in new renewable energy generation. Large amounts of new grid-scale wind and solar power generation are required soon for us to meet our renewable energy targets.

This audience needs no reminder that revenues from sale of solar and wind power have come from two sources: sale of energy; and sale of LGCs within the RET. Prices for both have fallen to levels at which the sum does not justify investment.

The mandatory requirements of the RET, set in 2015, rose to 33 Twh per annum by 2020 and continue until 2030.

After the uncertainty about the future of the RET was settled by a Government-Senate compromise in 2015, there was a period of strong renewables investment through the remainder of the Coalition Government extending into the beginning of the Labor Government in 2022. The 33 Twh target was met in 2020.

The RET continued to play a major role in driving renewables investment for several years after the 2020 target was reached. This is because LGCs provided an internationally and domestically trusted instrument for certifying voluntary purchases of renewable energy. Voluntary commitments cannot be relied upon to reach strong outcomes, but through the early 2020s they were all Australia had for new investments, and they were substantial.

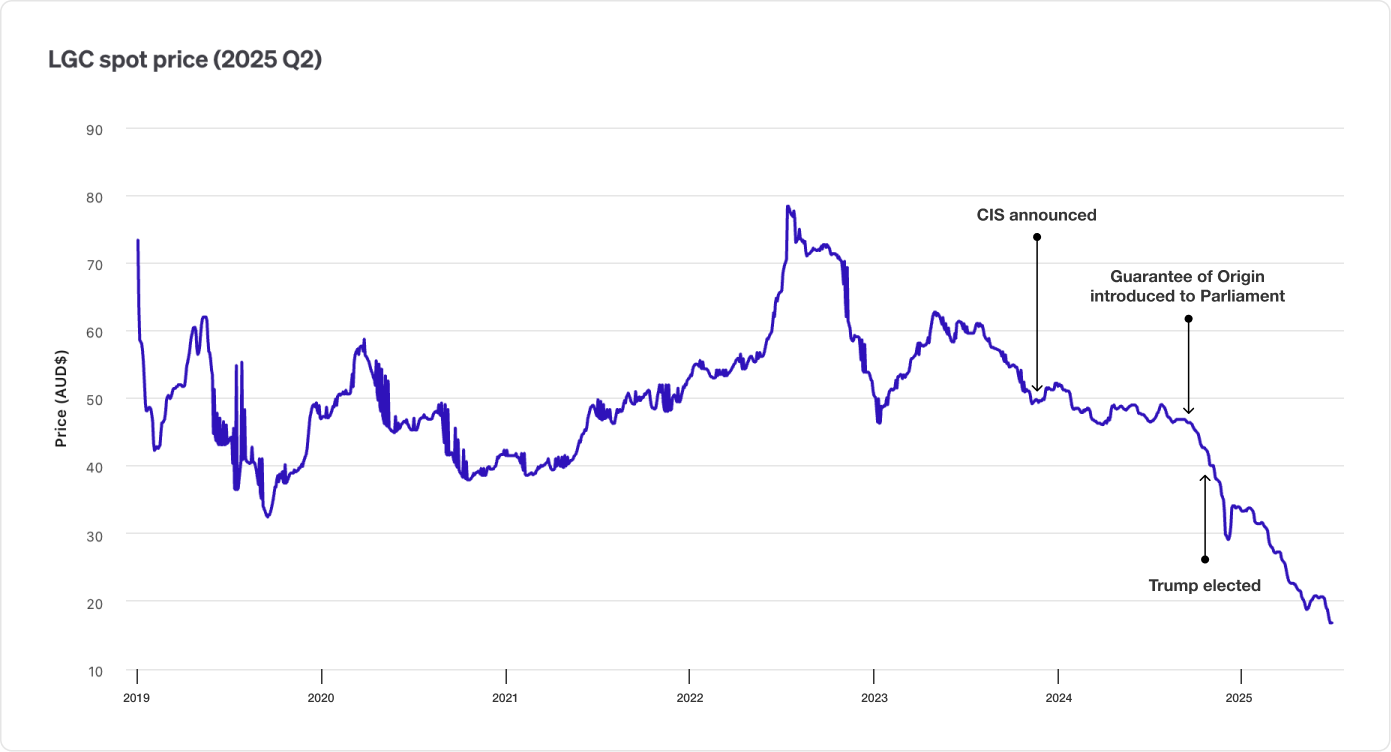

Voluntary commitments to purchase LGCs in excess of mandatory requirements kept LGC prices fluctuating around $50 per Mwh (Figure 1, all in inflation-adjusted prices).

Detailed analysis in the early 2020s demonstrated that that was likely to continue until the mandatory obligations under the legislated RET ceased in 2030, after which new policies would be required to maintain a green premium.

LGC revenues kept investment in solar and wind generation high despite falling and eventually low wholesale prices through the early years of the 2020s. The momentum weakened as the end of the mandatory RET came closer year by year. The Government needed to take some action to support investments which depended on expectations of revenue after 2030. There were suggestions from some economists, including myself, and from the Clean Energy Council, that the solution was extending and strengthening the RET. Speaking for myself, I judged at the time that it was too soon to expect consideration to the first best policy: a return to carbon pricing.

Instead, the Government extended the Capacity Investment Scheme to cover solar and wind generation.

Announcement of the extended CIS was one of several Commonwealth policy and other changes that led to a slowing of voluntary commitments to use renewable energy. The election of President Trump in November 2024 has been latest of these developments. Trump had loudly announced his opinion that commitments to using renewable energy were bad. Many companies with operations in or having other links to the US felt compelled or took the chance to dump voluntary commitments.

For gas and coal generators, revenue is from wholesale energy sales without LGC revenues, now supplemented by payments of unknown amounts from state governments in the eastern states.

Figure 2 shows total receipts from energy and LGC sales for various kinds of power since 2012-13. Prices are inflation-adjusted to mid-2025. Average wholesale prices are substantially higher since than during the two years of carbon pricing, financial years 2013 and 2014. They reached their greatest height during the early disruption of the Russian invasion of Ukraine. They are rising again now despite rapidly falling solar and wind prices including LGCs, because coal power prices have lifted and gas power prices have gone through the roof. Average gas power prices are now much higher than during the height of Ukraine disruption, despite gas commodity prices having fallen back. They have been driven to a considerable extent by the loosening of inhibitions in the use of oligopolistic power to lift prices. At times, gas generators reduced output when low renewable output was lifting market prices above the average.

Figure 2: NEM returns to power generators after LGC receipts (2025 Q2)

Data for South Australia, the state with no coal generation and more wind and solar, are shown in Figure 3. Average wholesale prices were higher in SA than elsewhere in the NEM early in the period when coal generation was still present, and renewables proportionately less important and expensive. As renewables expanded and fell in price, average SA wholesale prices fell below the NEM for several years. Over the past year, they have risen sharply to above the NEM average, driven entirely by higher prices for gas power.The oligopolistic power of gas generators is greater in SA than elsewhere in the NEM, and recently it has been used with less inhibition than in earlier years.

Figure 3: South Australia returns to power generators after LGC receipts (2025 Q2)

Revenues from solar power slumped to very low levels in 2024-5. They are much lower still in July 2025 as the effect of collapsing LGC prices has its effect.

There are now virtually no new investment commitments for solar and wind generation that do not have CIS or other Government underwriting. The underwriting falls far short of the levels necessary to reach the 82 percent target. The big gap on the current trajectory is growing wider now that demand for power through the grid is growing again with electrification and data centres.

The low revenue expectations are now leading to reconsideration of decisions to proceed with solar and wind generation investments that have received investment approvals and Government underwriting.

Harnessing the Power of Markets

Markets work wonders for economic development if they operate efficiently. It is accepted wisdom in economics that for markets to be efficient, external costs have to be corrected by a tax, or by regulatory restriction of the activities generating the costs, That is why an overwhelming proportion of the members of the Australian Economics Society responding to a recent survey said that Australia should price carbon.

We would learn something important if the Chair of the Productivity Commission, and the Chair of the Nelson Panel on Wholesale Electricity Market Review, and the Secretary of the Treasury, and the Governor of the Reserve Bank of Australia were asked to answer a question in public about whether economy-wide carbon pricing is better for the economy and the welfare of Australians than any other instruments for reducing emissions. We would learn more if they were asked whether economy-wide carbon pricing is immensely superior to any greatly overhauled and improved version of the Safeguards Mechanism.

What price?

The price that covers the cost of the damage that a firm’s carbon emissions imposes on others. In an efficiently operating market economy, that is also the cost of reducing emissions economically to net zero. The economically efficient price will rise over time at the relevant interest rate. In practice, it is something like the European Union carbon price now (around $120 per tonne) rising at an appropriate interest rate until we reach net zero. The European carbon price is set through application of sound principles, so let’s use that as our guide. That has the additional advantage of allowing CBAM-free entry of Australian products into the EU (and the UK and other countries with similar pricing systems). This will encourage our major partners in Northeast Asia to use the European carbon price as a guide, which will support the Superpower developments in Australia.

Once carbon pricing at an appropriate rate is in place, there is no case for anyone arguing on climate grounds about whether coal or gas or nuclear or wind or carbon capture and storage is desirable. All forms of energy and all ways of reducing emissions can compete on a level playing field. There is no need then for a climate trigger in environmental legislation. Nuclear power, which is genuinely zero emissions like solar and wind, gets the same advantage on climate grounds as wind or solar. Gas gets an advantage over coal because it does less climate damage. Geological carbon capture and storage is rewarded for its reductions in emissions at the same rate as renewable energy. So is sequestration of carbon in plants and soils.

When we get to net zero (by 2050 under current bipartisan policy), there will still be some emissions from industries in which removal is exceptionally costly. These will be balanced by negative emissions from rigorously measured and accounted sequestration of carbon in soils, plants and geological structures that are encouraged by payments at the carbon price. If the secure sequestration of carbon is authoritatively measured and accounted and the investments are profitable, they will have a role in the economy of the future.

Policies Accompanying a Carbon Price

Supporting policies would include a Carbon Border Adjustment Mechanism (CBAM). This wheel has been invented in Europe and there is no need to reinvent it. We can adopt the EU CBAM.

Supporting policies would include a payment to households to offset any transitional wholesale power price increases affecting them—perhaps in the form of the payments now being made through the Commonwealth budget, with the amount adjusted if necessary for changes in wholesale prices driven by carbon pricing. Zero-carbon exports would receive support along the lines suggested by The Superpower Institute pending other countries’ adoption of measures that introduce a green premium.

Supporting policies could include removal of the fuel excise tax and introduction of road congestion and user charges. Road users would pay a sum equal to the external carbon costs that their carbon emissions imposed on others (zero for electric vehicles using renewable energy) and the costs of their use of roads. Off-road consumers of petroleum would only pay for the external costs of their carbon emissions. Payments by most road users would be moderately lower and by off-road petroleum users appropriately higher than under current arrangements. If there were delays in introduction of road user and congestion charges, the fuel excise would be continued at a lower rate with exemption for off-road users, alongside payment of the carbon price.

On the expenditure side of the budget, contingent liabilities from the CIS and the states’ underwriting schemes would be greatly reduced by higher renewable energy revenues from carbon pricing. The carbon price would lift the whole energy market, including through initially increasing incentives for investment in storage and short-term gas or other peaking. Some other measures that encourage zero-emissions activities could be phased out, as they were when carbon pricing was introduced in 2012.

What form of carbon price?

It could be the old Australian ETS as it operated 2012-14. Or it could be the carbon solution levy (CSL) that Rod Sims and I suggested at the National Press Club in February 2024 (see Chapter 12, Lets Tax Carbon). The CSL as proposed would raise much more revenue because it would tax the carbon emissions embodied in Australian exports of coal and gas until our trading partners were implementing policies that generate an appropriate green premium for Australian exports.

Our consultations with some major Northeast Asian trading partners have revealed acute anxiety about increases in import prices from the CSL—improvements in Australia’s and deterioration in their own terms of trade. These include countries that we expect to be our main markets for zero-carbon goods. We need to develop policies that generate a green premium for Australian exports without creating distrust or unnecessary large uncertainty about the operation of commodity markets upon which they rely. The Superpower Institute is working through the issues. Application of the CSL only on domestic sales would generate less revenue than the old Australian ETS.

How would carbon pricing relate to the RET during its remaining years?

I suggest that any LGCs that had not been surrendered to the Australian Energy Regulator or destroyed within voluntary commitments by 2030 could be credited against carbon price obligations at an exchange rate reflecting the average carbon intensity of the Australian grid. This would immediately restore strength to demand for LGCs and incentives for private market-driven investment in solar and wind. This would accelerate growth in renewable energy output towards the 82 percent objective. It would also reduce contingent liabilities under the CIS and state underwriting schemes.

At what time?

For climate and the economy, as soon as possible. The CSL is simple, and could be introduced quickly. The old Australian ETS was legislated in mid-2011 and was operating smoothly by mid-2012. The machinery of the ETS has not been destroyed, so that the time required for implementation after legislation would be less than in 2011-12. The Government would want discussion at and after the August Summit to run its course. It may want to delay introduction of carbon pricing until after the election due in 2028. The delay would not postpone the increased incentives for renewable investment if it were accompanied by provisions for unutilised LGCs to be credited against future carbon price obligations.

The Australian economy has been performing badly for its citizens. For all the sound objectives and good intentions of the Albanese Government, we are yet to correct the inadequacy of our contribution to the global climate change mitigation effort since 2013. Let’s stop kidding ourselves in the 48th Parliament. Let’s start telling the truth. The truth is that early adoption of carbon pricing is in Australia’s national interest, and needs to be considered as a matter of urgency.

Ross Garnaut

Director

Ross Garnaut AC is a renowned economist specialising in development, economic policy and international relations. He is Professor Emeritus at the University of Melbourne and a Fellow of the Australian Academy of Sciences. His contributions to trade policy and climate change have made him a trusted adviser to successive Australian governments.