As the world moves rapidly to decarbonise, nations will face rising pressure to source low-emissions materials for industrial use. Australia is uniquely positioned to meet this challenge – thanks to abundant iron ore reserves, world class renewable energy and geographic proximity to major markets.

A Green Iron Plan for Australia: Securing Prosperity in a Decarbonising World presents a detailed economic blueprint for green iron production in five Australian regions. The report shows that, with the right policy settings, Australia could become a major exporter of decarbonised iron, replacing the value of declining fossil fuel exports and laying the foundations for a new industrial era.

Ingrid Burfurd, Carbon Pricing and Policy Lead, TSI“This report shows what’s needed to turn Australia’s green iron potential into reality. We can’t expect markets to fix themselves. We need policy leadership to back early projects, close the cost gap created by the lack of an international carbon price, and to help lay the foundations for a globally competitive industry. This plan shows the way."

Overview

Australia is uniquely positioned to become a world leader in green iron production.

Its natural endowments – abundant iron ore and a comparative advantage in low-cost renewable energy – make Australia the natural home for this emerging global industry. With soundly based policy settings and timely action, this opportunity can underpin prosperity for generations.

Research by The Superpower Institute shows that the future energy trade will not be dominated by fossil fuels, but by trade in goods that embody clean energy. Energy-intensive industries will migrate to regions where cheap renewable energy exceeds domestic needs. Australia is one of those rare regions.

There are three compelling reasons to develop a green iron industry in Australia.

- Green iron is an economic opportunity of historic scale. By leveraging its advantages in iron ore and renewables, Australia can move up the value chain from exporting raw commodities to higher-value industrial materials. The potential is enormous: if green iron replaces iron ore as a primary export, it could generate up to $386 billion annually by 2060. By comparison, Australia’s iron ore exports are typically around $120 billion per year.

- Green iron offers a large opportunity to contribute to global decarbonisation. Conventional steelmaking remains one of the largest industrial sources of carbon emissions worldwide. An Australian green iron industry could abate emissions equal to roughly 4 per cent of the global total – more than three times Australia’s current domestic emissions.

- Green iron exports provide a strategic hedge against the decline of fossil fuel exports. Coal and gas are two of Australia’s three largest export industries, currently generating around $120 billion in export revenue each year. Yet most major economies have committed to achieving net-zero between 2045 and 2070. The timeline and trajectory of global decarbonisation may be uncertain, but the direction is clear: fossil fuel markets will contract in the coming decades. Investing today in industries where Australia enjoys a comparative advantage – such as green iron – is the most prudent way to safeguard national income and employment.

But a green iron industry cannot be built overnight.

If Australians want to capture the economic benefits of green iron, the Australian government needs to introduce policies that correct three market failures: the absence of a global carbon price, the lack of early-mover support, and underinvestment in common-user infrastructure.

These market failures constrain Australia’s green iron potential. This report lays out a plan for Australia to take full advantage of its green iron opportunity. It first explains the technologies and pathways for producing green iron in Australia. Secondly, it examines in detail the costs and competitiveness across five key production regions. Finally, it outlines the policy measures needed to incentivise local production and build global demand, positioning Australia as a leading exporter of green iron.

Australia’s Export Base is at Risk

Australia’s exports are extremely vulnerable to global decarbonisation. International commitments suggest coal use will decline by 35 per cent by 2040 and nearly 50 per cent by 2050, and announced pledges suggest a decline of 62% by 2040 and nearly 80 per cent by 2050.

The global trade in thermal coal is forecast to decline

If declines of this magnitude occur it will hit Australia hard, because Australia is the world’s top exporter of metallurgical coal and top combined exporter of thermal coal and Liquid Natural Gas (LNG). Coal and gas are Australia’s second and third most valuable export industries, with coal exports typically worth about $70 billion each year, and LNG about $50 billion.

If the world decarbonises in line with current commitments, Australia will progressively lose income from fossil fuel exports, with resulting job losses concentrated in particular regional and remote areas.

Even if the pace of decarbonisation is slower and less coordinated than current commitments indicate, green export industries are a natural hedge against uncertainty and the risk of these losses, because the international economic pressures that will erode Australia’s fossil-fuel exports are the same pressures that can be harnessed to secure zero-carbon exports. The employment opportunities for green exports include many of the large fossil-fuel production centres in Australia.

As shown in The New Energy Trade, if Australia can successfully develop green exports to their full potential, these industries could replace the value of fossil exports several times over. ‘Superpower exports’ would make it possible for Australians to enjoy rising living standards and full employment for several generations.

If Australia makes green iron with its approximately 40 per cent share of global iron ore production, it could earn almost $400 billion a year from green iron exports.

The New Energy Trade

To keep global warming below 2 degrees Celsius, and to have a chance of limiting warming to 1.5 degrees, substantial mitigation is required by the end of the decade. The lowest-cost pathway for achieving 1.5 degrees requires global emissions to fall more than 40 per cent on 2019 levels by 2030. To achieve this, energy systems and industrial processes need to decarbonise quickly.

As the world decarbonises, carbon emissions will become more expensive. Energy-intensive production will need to relocate to locations with low cost, abundant zero-emission energy. This will reshape global production and trade.

Current trade patterns reflect the era of cheap fossil fuels. Countries have enjoyed a comparative advantage in the production of energy-intensive goods, even when they lack low-cost energy, because fossil fuels are cheap to transport - typically 10 to 15 per cent of the total cost. As a result, for example, Japan and South Korea are major producers of energy-intensive steel, even though they need to import nearly all the required energy.

This will change. Transporting zero-carbon energy is far more expensive. It requires sea-bed cable or conversion into tradeable carriers like hydrogen or ammonia – doubling the cost of renewable energy. The transition to zero-carbon sources will push energy-intensive industries to countries with abundant, low-cost renewable energy.

Australia’s renewable energy advantage

Australia has remarkable renewable energy resources. It is large, with solar irradiance levels comparable to solar-rich areas like northern Africa and the Middle East. Australia also has excellent wind resources, particularly in southern and coastal regions. Many inland regions have a high ‘combined’ renewable energy capacity factor because wind and solar production patterns are complementary, reducing the need for costly energy storage.

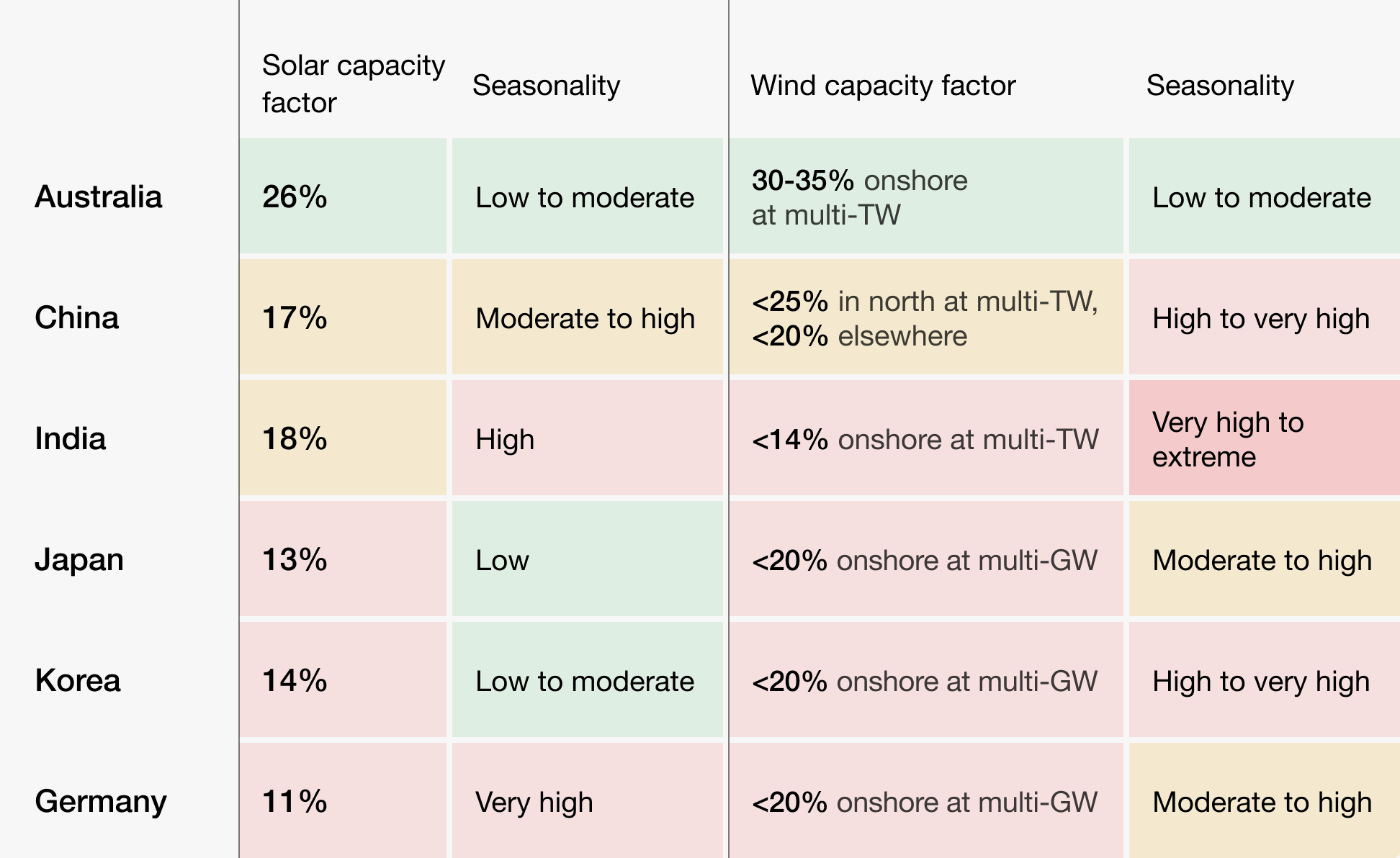

Australia also benefits from low seasonality in its renewable energy resources. Low seasonality is important for supplying consistent year-round energy at low cost. Strongly seasonal weather patterns require expensive investments that are productive in one season, but sit idle in another. For example, wind capacity varies dramatically between monsoon and non-monsoon seasons in equatorial areas.

Compared to key trading partners and steelmaking nations, Australia has excellent renewable energy resources, with high capacity factors and low seasonality.

In TSI’s 2024 report, The New Energy Trade, a distinction is made between ‘tradeable’ and ‘non-tradeable’ energy demand. In countries like China, India and the EU, rising non-tradeable demand will push energy-intensive industries up the cost curve. Japan and South Korea already face some of the highest renewable energy prices in the world and have little room to grow. These regions will struggle to meet their mid-century energy needs.

Australia, by contrast, has abundant resources and a small population. With the right investments, it could supply renewable energy far beyond domestic demand, keeping prices low by global standards.

Green Iron: A leading superpower export

Australia also has large reserves of iron ore, bauxite, and critical minerals like lithium, copper, cobalt, and nickel. This rare combination of low-cost energy and rich mineral reserves creates a unique platform for exporting green metals.

Of all potential superpower exports, green iron has the greatest economic potential. Global demand for primary steel is expected to grow through to 2050, despite rising recycling rates. Australia’s iron ore exports – nearly 900 million tonnes – make up more than 40 per cent of global production and over half of international exports by mass and value.

With low-cost renewable energy, Australia could process this ore into green iron and export it. At full scale, these exports could be worth up to $400 billion per year. Green iron could also make currently uneconomic mines viable and help producers hedge against future declines in demand from traditional trade partners.

Green iron leads the other superpower commodities in terms of potential export revenue

Source: The Superpower Institute 'The New Energy Trade'

Green iron technologies will be able to use Australian ore

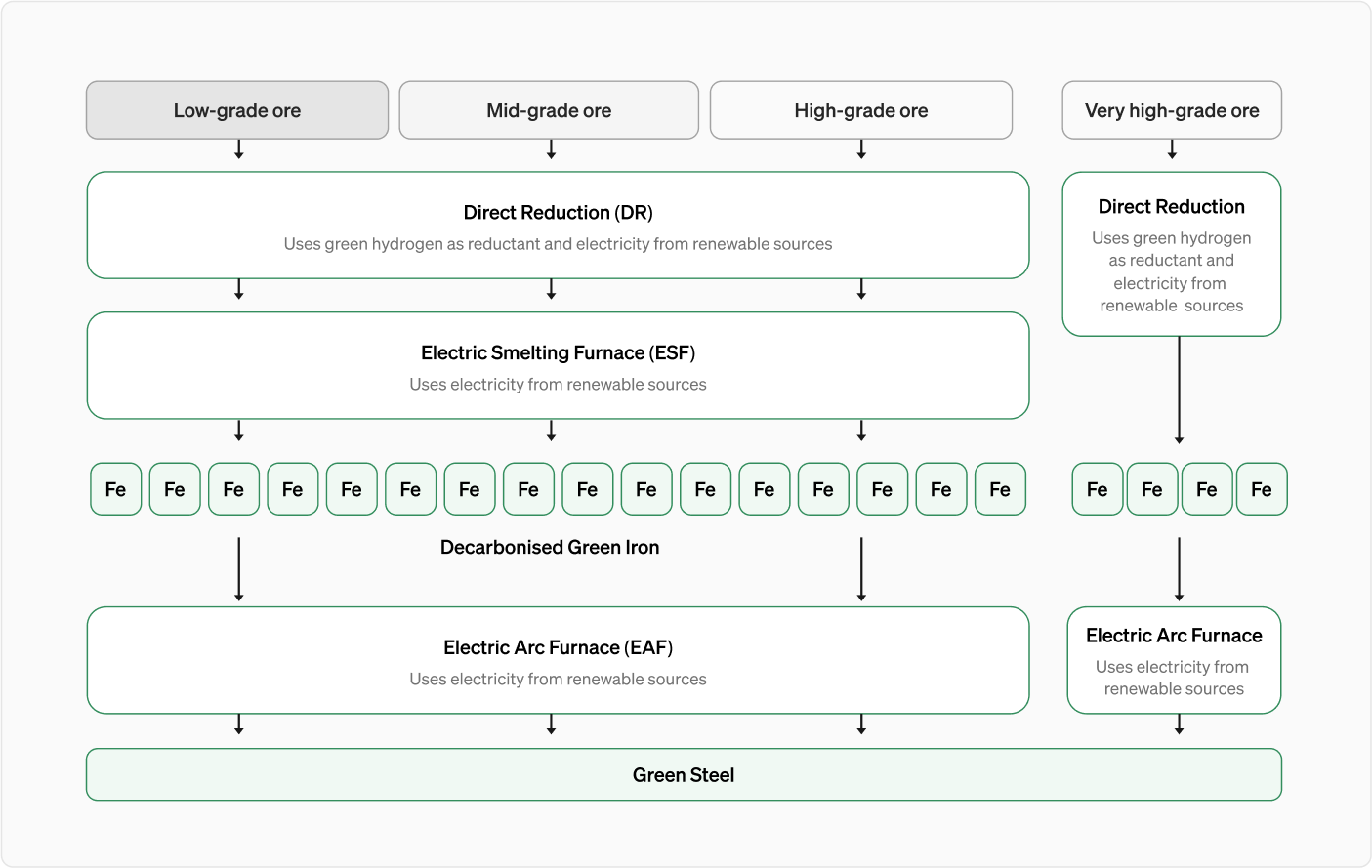

Most iron and steel is made in the carbon-intensive blast furnace-basic oxygen furnace (BF-BOF) process. ‘Direct reduction’ technologies use methane or hydrogen to produce directly-reduced iron (DRI). If green hydrogen is used, the result is green iron.

Low, mid, and high-grade ores can be used in the direct-reduction iron-making process, with the quality of the resulting DRI reflecting the quality of the ore. Currently only high-grade ore is used to produce DRI, because lower-quality DRI requires additional processing in an electric smelting furnace (ESF) to produce high-quality DRI.

Australia currently exports mainly low- and mid-grade iron ore. Green iron producers using DRI technology in Australia will have two options:

- Mine and process higher-grade Australian ores with direct-reduction technology

- Pair direct reduction with electric smelting furnace (ESF) technology to process lower and mid-grade ores.

The process of making iron: Green vs Carbon-intensive

In the short term, green iron producers will probably use high-grade ores with established technologies. Over time, advances in ESF technology and next generation green iron technologies will expand the use of Australia’s vast lower and mid-grade ore resources, opening up much larger production potential.

Modelling five Australian green iron production locations

The Superpower Institute, in partnership with Bivios, has modelled green iron production in five locations in Australia.

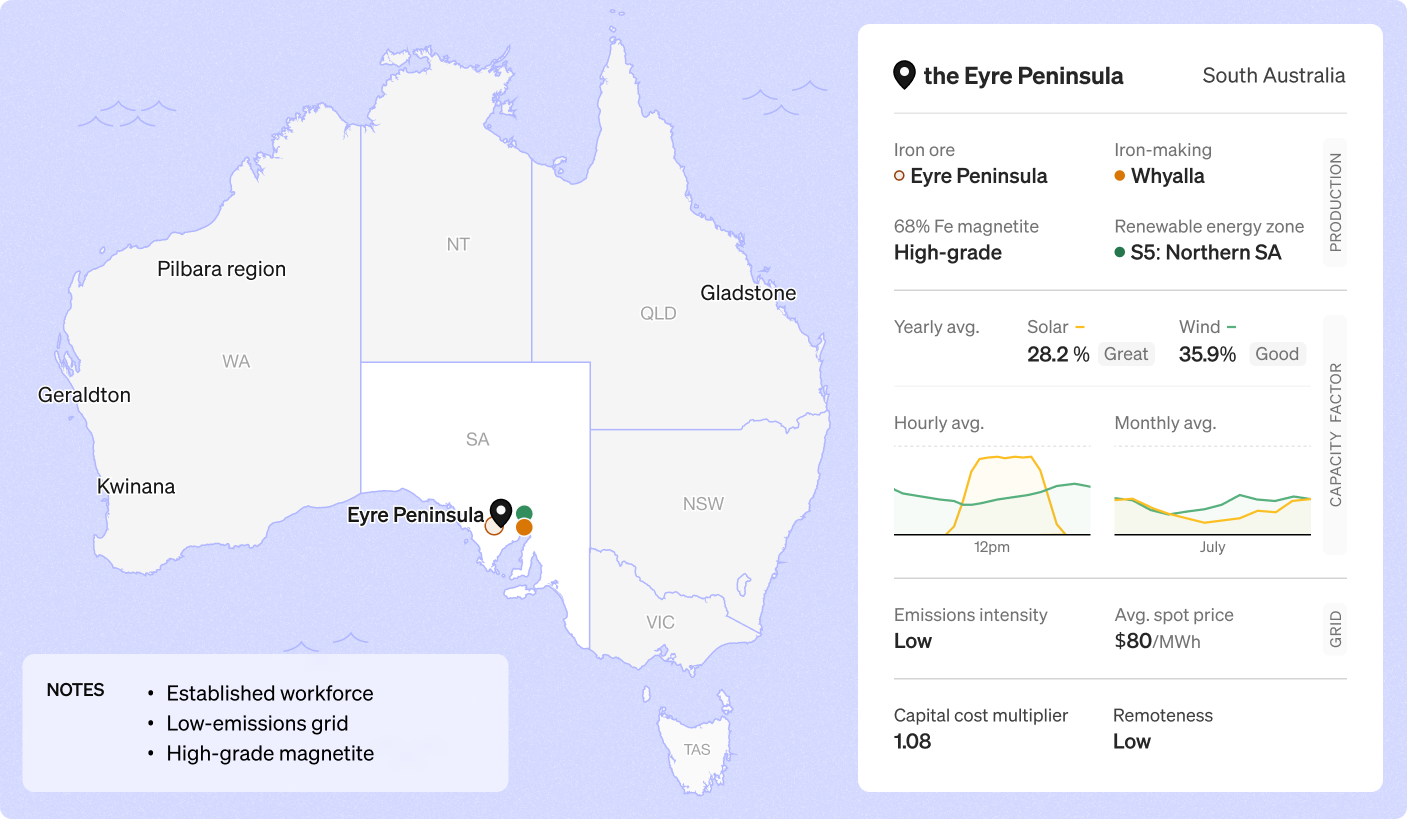

The five locations – Eyre Peninsula, Geraldton, Pilbara, Gladstone and Kwinana – were selected to reflect a range of renewable energy resources, ore grades, infrastructure access and electricity market conditions.

Eyre Peninsula and Geraldton benefit from access to high-grade local ore, while Pilbara, Kwinana and Gladstone model scenarios use lower-grade Pilbara ore, which requires additional smelting. All locations except the Pilbara are connected to wholesale electricity markets, enabling flexible energy use and trading. Together, these sites provide a representative cross-section of Australia’s green iron potential.

Green iron production location profiles

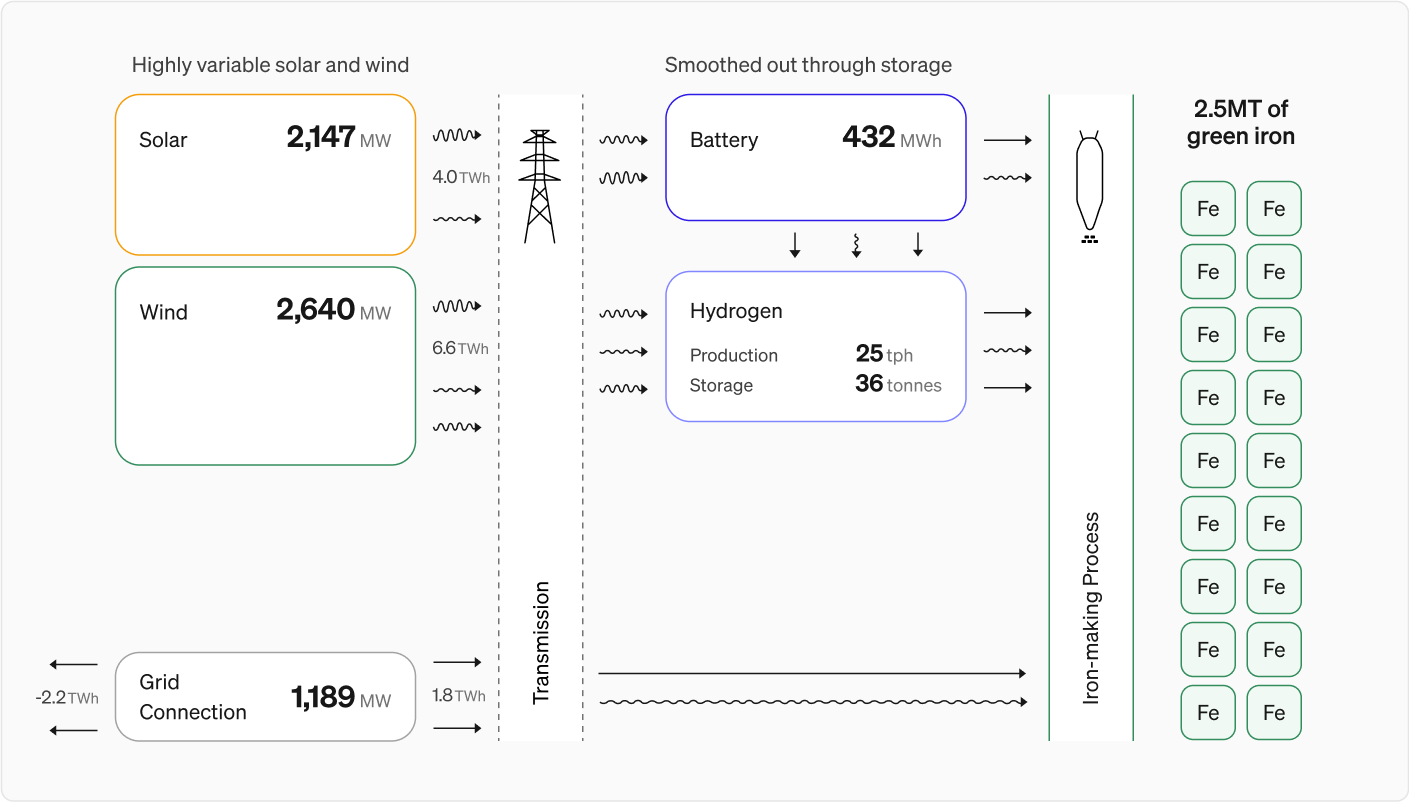

The model simulates the full green iron production chain – including production and storage of renewable energy, green hydrogen and green iron, and solves for the lowest-cost combination of investments and production patterns that can produce 2.5m tonnes of green iron in a year.

Production is modelled for different grades of iron ore, based on the characteristics of iron ore in each location, or the characteristics of ore transported to each location. Different grades of iron ore have different costs and benefits. Hourly weather data and energy market prices are used to estimate the costs of producing a tonne of green iron in each location, producing a levelised cost of iron (LCOI).

Two types of iron making technology were assessed:

- Inflexible technology. Runs almost constantly, needs continuous energy and hydrogen.

- Flexible technology. Can ramp production up and down as energy availability changes.

The model shows how the LCOI varies dramatically across Australia. The Eyre Peninsula, Gladstone, and Geraldton are the lowest-cost locations, with Pilbara iron ore shipped to Gladstone, and Geraldton using ore from the mid-west of Western Australia.

Core Findings

Our model shows that location, technology, energy supply and infrastructure shape the cost of green iron production. We find that Australia can produce green iron at industrial scale using renewable energy - but costs vary widely by site and technology.

The cost of producing green iron varies by technology type

The Superpower Institute, Bivios

1. Technology flexibility matters

Flexible green iron technology, with the ability to ramp production up and down, will likely reduce the cost of producing green iron compared to technologies requiring continuous operation. However, flexible technologies are still under development and will require innovation support to be realised at commercial scale.

2. A grid connection can reduce costs

Access to an electricity market plays a critical role in reducing costs. Grid-connected locations (all modelled locations except the Pilbara) can draw power during lulls in renewable generation and sell surplus energy during high-price intervals.

3. Location is critical

Despite the geographic advantage of abundant iron ore deposits, the Pilbara is unlikely to be one of Australia’s lower-cost locations for producing green iron, at least initially. Other locations in Australia face lower capital costs, have advantages in existing infrastructure, and some regions have superior renewable energy capacity factors. It may make economic sense to ship ore from the Pilbara to other locations in Australia where green iron can be produced more cheaply.

4. Variable renewable energy works at an industrial scale

With the right combination of storage, flexible technologies and grid access, variable renewable energy can be used to produce millions of tonnes of green iron each year:

5. Market distortions constrain competitiveness

Potential green iron producers are disadvantaged by the lack of an international carbon price. This distorts the international market for iron products, and creates an inefficient advantage for fossil-fuel based products.

This market failure is a major reason that there is a cost gap between the international price of carbon-intensive iron products and the estimated production costs of Australian green iron. The cost gap for most producers is substantial. Producers in the Eyre Peninsula and Geraldton have lower costs than other producers, and our model suggests they may be able to compete in small segments of the market where there are particularly high prices. Other producers face a cost gap up to $1000 per tonne, depending on the production technology and site location.

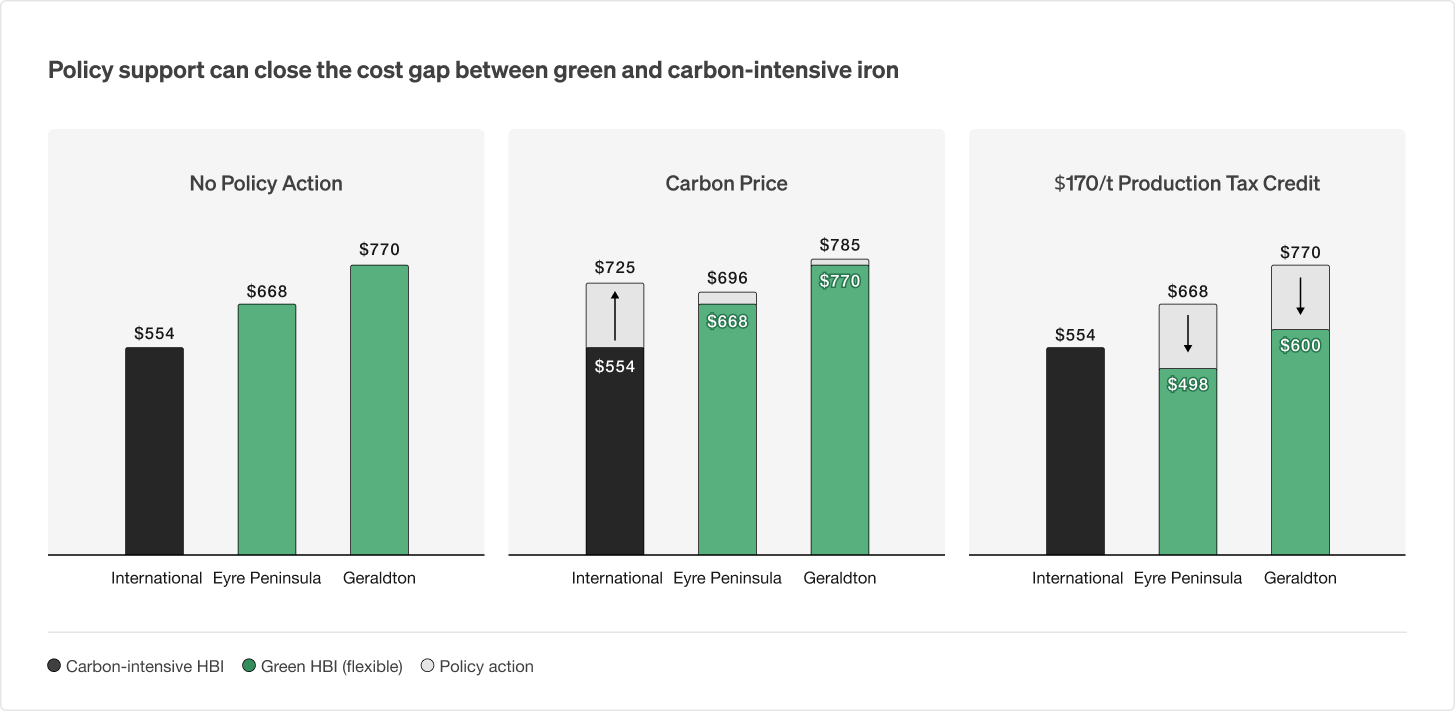

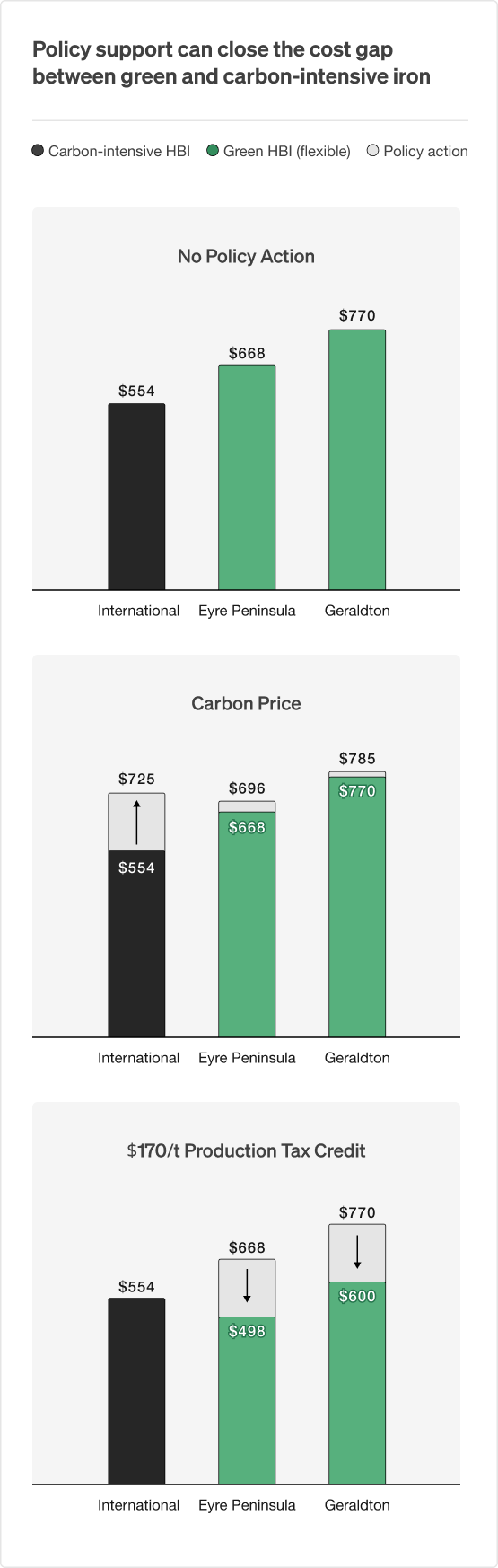

6. Policy action can close the cost gap

Results from the model show that policies addressing market failures will help Australia seize its green iron potential.

If iron producers paid the expected EU carbon price in 2030 – $155 per tonne– the cost of conventional, fossil-fuel-based iron production would rise significantly and the green premium would narrow. We find that producers in several locations would be able to compete in the international market, and producers in the Eyre Peninsula would be able to compete with a much broader share of the international market for iron products.

Bridging this gap requires targeted policy action – not to subsidise inefficient production, but to correct clear and broadly recognised market failures that conceal the true costs of high-carbon products.

How to fix market failures and support green iron exports

Our modelling shows that even in the most favourable locations, green iron production remains uncompetitive without targeted public policy. The cost gap with carbon-intensive iron is wide in many locations, reflecting the missing carbon price. Early producers face elevated risks for which they will not be compensated. Essential infrastructure will not be built by private investors.

To bridge these gaps, governments must take decisive steps that correct for market failures: by simulating the effect of a carbon price, incentivising innovation and early movers, and contributing to building shared infrastructure. Governments should also engage diplomatically to stimulate demand in target international markets.

The Superpower Institute identifies three key market failures that warrant government intervention:

- Unpriced emissions from fossil-based production. Because there is no system of international carbon prices, iron and steel producers do not pay the social cost of their carbon emissions. The lack of carbon price makes it difficult for green iron to compete with carbon-intensive iron in international markets. To correct for the lack of an international carbon price, the federal government should provide green iron production tax credits.

- Under-provision of common-user infrastructure. Like other major industries, green iron production requires large-scale, shared infrastructure – roads, transmission lines, pipelines and storage, and upgraded ports. These assets have strong spillover benefits that private investors cannot capture, so the private sector will not invest in them at the efficient scale. Public investment is essential to ensure this infrastructure is delivered at lowest cost.

- Innovation spillovers and early-mover risk. In establishing new industries, early producers absorb the costs of technical learning, process optimisation, and supply chain development. They confer large benefits on later producers, without reward. Without policy support, this disincentivises early investment. To correct for positive externalities created by early producers, the government should offer capital support worth up to 30 per cent of the investment cost for a green iron project.

These market failures constrain what Australia could otherwise achieve. The Superpower Institute has developed a detailed set of policy recommendations.

With efficient support, Australian green iron can be cost-competitive. A green iron production tax credit worth $170, including the value of the existing hydrogen production tax incentive (HTPI), would have a very similar effect to a carbon price.

Levelling the playing field for Australian green iron producers

Our proposed production tax credit would address the market distortion created by the missing carbon price. It would narrow or eliminate cost gaps, and expand the number of locations where green iron producers can compete in the international market. It would also mean low-cost producers are better able to compete in the international market.

Cost of green and carbon-intensive iron with no policy action

Recommendations

To seize its green iron opportunity, Australia must correct market failures and align policy settings with the emerging global market. The following recommendations outline the actions required to establish a competitive green iron industry:

Correcting for the missing international carbon price

In addition to its $2 per kilogram support for green hydrogen, the government should provide support for green iron production to simulate the effects of a carbon price. We estimate total support, including the Hydrogen Production Tax Incentive (HPTI), should be worth at least $170 per tonne of green iron in 2030. This could be achieved with a ‘stackable’ production tax credit for green iron. The production credit should rise to maintain equivalence to the EU carbon price.

Some nascent green iron production technologies do not use hydrogen, but may use significant amounts of renewable energy dedicated to iron-making. Here, the HPTI does not help close the cost gap between green iron and carbon-intensive iron. The government should provide support that simulates the effect of a carbon price for non-hydrogen-based green iron technologies. This could take the form of an expanded production credit for green iron, worth at least $170 per tonne of green iron in 2030.

Supporting positive spillovers from common-user technology

In locations that are most promising for multiple green iron projects, federal and state governments should support new natural-monopoly infrastructure that is essential for green iron, steel, and other green exports: electricity transmission, hydrogen pipelines and storage, ports, and desalination and water supply in areas with no local water supply. This can be direct government investment or support to private investors. Government’s role in supporting infrastructure will solve the coordination problem that will otherwise delay or prevent investments in green iron production.

Infrastructure use should be priced efficiently, so the cost of using infrastructure is not a barrier to early private investment in green iron.

Support green production in low-cost locations

We propose an Australian green hydrogen certificate scheme, with green hydrogen producers earning tradeable certificates. Certificates could be purchased and surrendered by green iron producers anywhere in Australia. Iron produced with natural gas could be recognised as ‘green’ iron production when equivalent green hydrogen certificates are purchased and surrendered.

Producers of other green hydrogen-based products would also be included in the scheme.

Supporting positive spillovers from early producers

The federal government should provide capital support for early commercial producers of green iron, with a planned output of at least 0.5 million tonnes per annum. This could build on or draw from the already announced $1bn green iron investment fund. Two levels of support should be available:

- Early investors in green iron projects, using any kind of green iron technology, should receive capital grants, or equivalent tax benefits, representing 15 per cent of capital costs. We propose that this support should be available for up to three green iron projects.

- Grants worth an additional 15 per cent of capital costs should be made available for the first few uses of a particular kind of green iron technology deployed in Australia.

Support should be capped at $500m per project.

Policies to support international trade dynamics

The government should shape its Guarantee of Origin (GO) certificates to be compatible with the EU Carbon Border Adjustment Mechanism (CBAM). This should be done at the earliest possible date after the EU legislates its requirements.

The Australian government should strengthen support for research on countries’ economic challenges and trade opportunities as the world decarbonises.

The Australian government should work with trade partners to secure financial support for Australian green iron production. This may come in the form of contributions by trade partner governments toward the supports described in Recommendations 1 and 2. Such contributions would recognise the shared benefits of successful Australian green iron production, to both Australia and our trade partners.

The federal government should use international platforms to advocate for a system of international carbon prices. It should demonstrate Australia’s commitment to the Paris Agreement with policies that impose or simulate the effects of a carbon price consistent with net-zero carbon emissions by 2050.