Model Methodology: A Green Iron Plan for Australia

The model simulates the dynamic behaviour of a complete green iron production system over an example year.

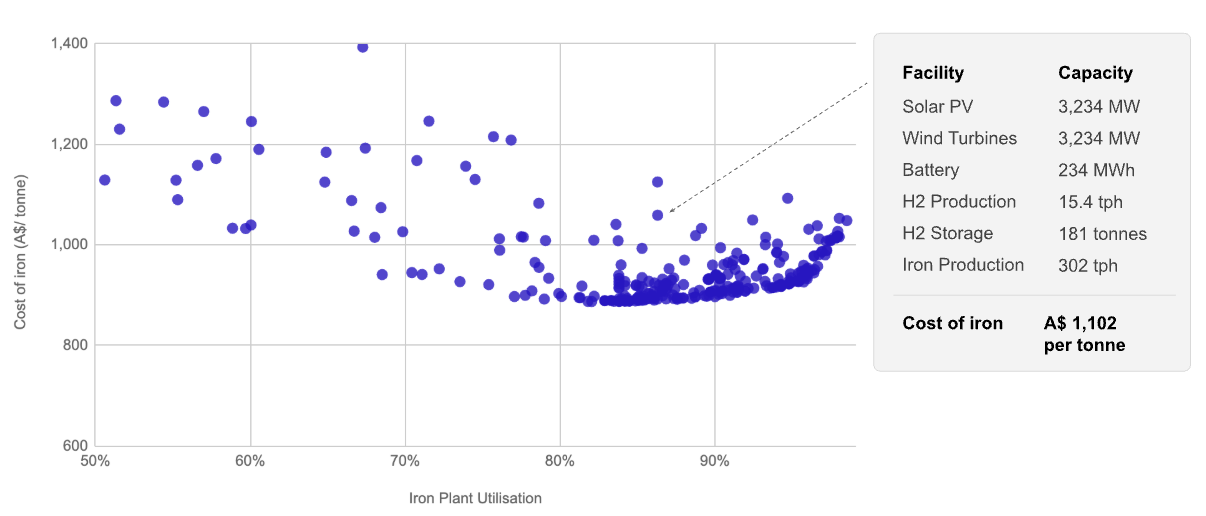

The simulation is run multiple times to identify the investments and production levels that deliver the lowest levelised cost of iron (LCOI). Each run of the simulation uses different combinations of investments and production volumes.

How the model simulates an iron production system

The simulation runs in hourly steps for a full year (8,760 hours).

Within each hour, the simulation estimates the energy required to meet iron-making needs. If the energy requirements can be met, then the iron-making system produces at full capacity in that hour.

If there is not enough energy available, the system will try to use stored energy (e.g., from electricity stored in a battery, or hydrogen). Electricity will also be drawn from the grid up to the limit imposed by connection constraints and the Hydrogen Production Tax Incentive (HPTI) carbon-intensity limit. If there is still not enough energy, other forms of production are constrained (e.g., water and hydrogen).

The model prioritises the supply of electricity to production processes in the following order:

- water processing (low energy use; a necessary input for all downstream processes);

- iron-making;

- hydrogen-making.

This approach ensures that the iron plant operates whenever hydrogen is available from simultaneous production or drawn from storage.

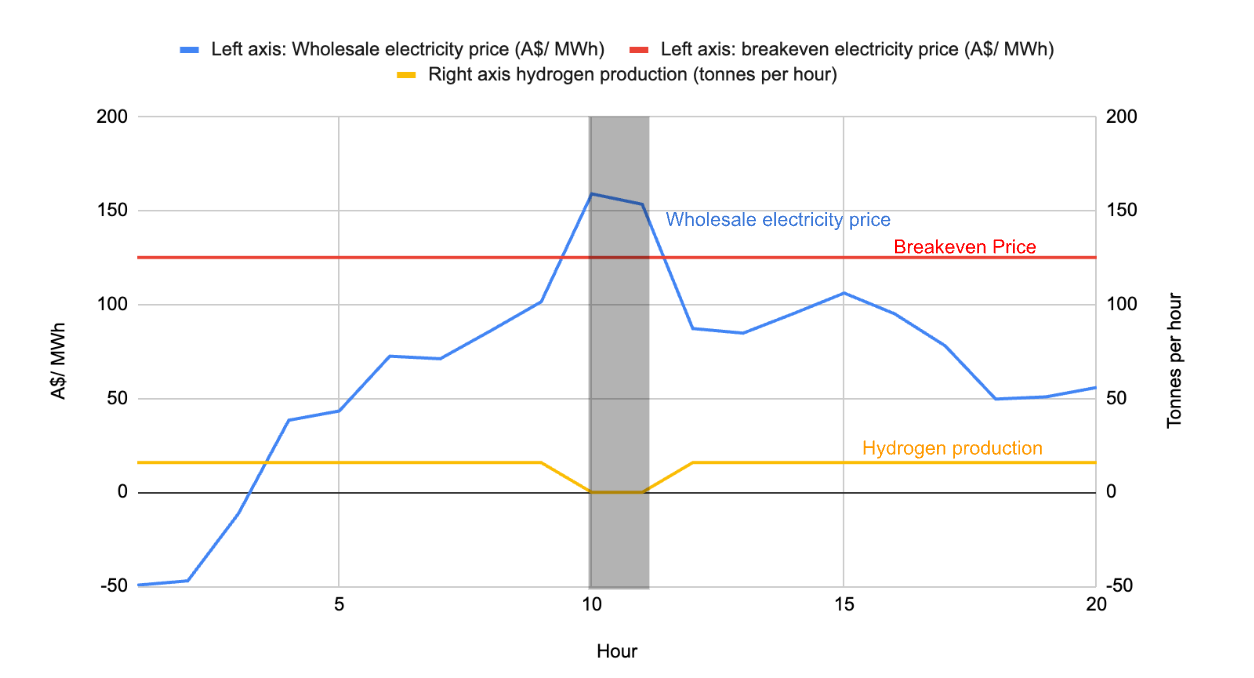

To capture the effect of producers selling renewable energy into an electricity market, we model a simple ‘selling’ rule: if the wholesale price of electricity is above a ‘breakeven’ price in a given hour, hydrogen production is curtailed and any available renewable electricity is sold into the electricity market. This ensures producers do not buy electricity when market prices are high, and allows producers to capitalise on high prices by selling available renewable energy. The ‘breakeven’ price is calculated based on an estimate of the value of electricity to the iron final product, based on an estimate of the final product’s market value.

Download the Model Input Data Pack

Download the Model Input Supplementary Material