Introduction

It is difficult, perhaps impossible, to think of a policy that better addresses the three objectives of the Roundtable - productivity, economic resilience and budget sustainability - than the introduction of a carbon price into the Australian economy. It would significantly improve productivity by replacing ad hoc energy transition measures with what all economists agree is a much more efficient and market-driven means of reducing Australian emissions. It would build economic resilience by better positioning Australia to embrace its comparative advantage in low carbon export industries. And it is likely the most efficient measure Australia could take to contribute to budget repair, enabling broader reform of Australia’s tax system.

Why a carbon price?

Carbon emissions damage our environment and so are a negative externality imposing large costs on society. Australia has recognised this through its commitments to net zero targets and policies associated with achieving that objective.

It is appropriate that government addresses such a large cost on society. However, the current approach is a complex matrix of discretionary government policies, creating inefficiencies in administration and investment.

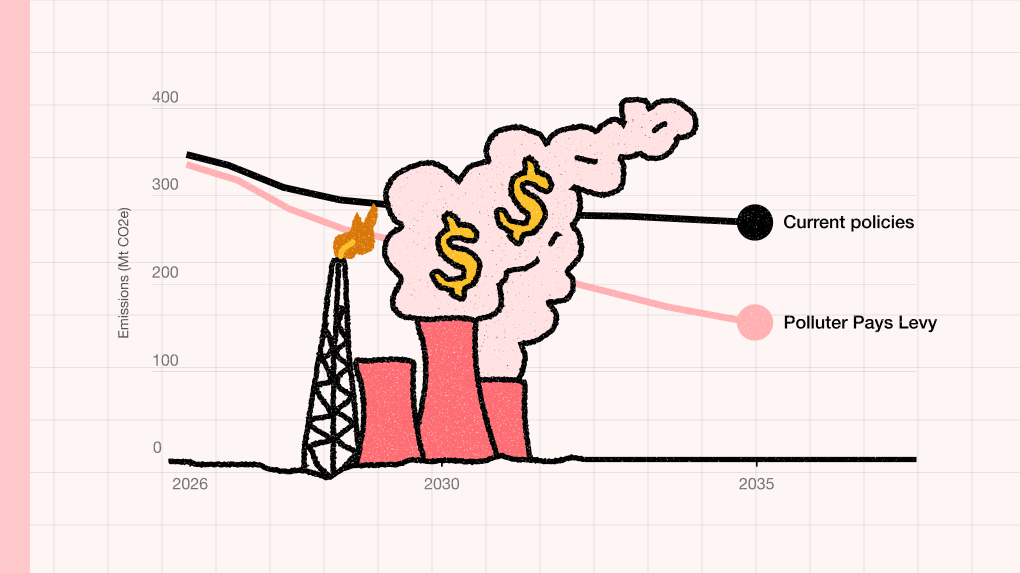

Further, Australia’s existing policies to promote decarbonisation and address climate change do not have us on track to meet our net zero goals (1). The effects of climate change are further damaging to Australia’s productivity and liveability.

The effects of climate change are further damaging to Australia’s productivity and liveability.

A carbon price has benefits including: administrative simplicity, predictability for industry, market-driven and capable of generating very large revenues for government.

1. Productivity

Governments increase national productivity by setting rules and correcting market failures so that resources flow to their most valuable uses. Climate change mitigation is no exception: by efficiently pricing the costs of carbon pollution, governments can drive investment towards low-emissions technologies, reduce long-term damage, and improve economic performance. Sound climate policy choices have the potential to boost productivity, while many current poor policy choices are a drag on growth and strain public budgets.

2. Economic resilience

Coal and gas are two of Australia’s three largest export industries, currently generating around $120 billion in export revenue each year. Yet most major economies have committed to achieving net-zero between 2045 and 2070. The timeline and trajectory of global decarbonisation may be uncertain, but the direction is clear: fossil fuel demand will contract in the coming decades. Investing today in industries where Australia enjoys a comparative advantage is the most prudent way to safeguard national income and employment.

A specific example of a threat to Australia’s economic resilience, is the availability of liquid fuels such as petrol and diesel, which are combusted in transportation and other industries in Australia. Almost all of Australia’s current liquid fuel supply is imported. This means significant exposure to risks in times of international supply chain disruption during wars or trade conflicts.

Australia’s exceptional capacity to produce renewable energy and biomass, however, makes it a clear standout location to produce low carbon liquid fuels. Developing this industry would not only strengthen Australia’s export profile but also enhance our energy security and economic resilience.

Implementing carbon pricing would help shift demand to low carbon products domestically in Australia, while adoption of carbon prices internationally will provide an avenue for Australia to take a significant share of the global market for low carbon fuels and other products. (2)

3. Budget sustainability

The Federal Budget is forecast to add nearly $180b to gross debt over the forward estimates, at a rate of between $27b and $47b per year. (3)

Current policies to reach net zero in Australia are often a large negative to the budget as they seek to simulate the effect of a carbon price.

TSI’s analysis reveals that, depending on the model of carbon pricing adopted, very substantial revenues - between $18b and $46b per year - could be generated for the federal budget. Access to this revenue would have a profound impact on the fiscal position of the government, enabling it to undertake other forms of tax reform, provide payments to assist with cost-of-living pressures and to invest in the industries of the future where Australia enjoys a comparative advantage.

Conclusion

The time is right for Australia to adopt a first best set of policies to address climate change, economic resilience and budget repair. Doing so will enhance productivity and assist the strength of the national budget.

Implementing a broad-based carbon price in Australia will:

- Contribute substantially, well beyond current policies, to lowering Australia’s emissions as we attempt to reach net zero by 2050, at lower cost than sector-specific policies.

- Contribute to a more sustainable and positive national budget position. Forthcoming work by TSI will demonstrate that carbon pricing, depending on the form adopted, can generate revenues for the federal budget of between about $18b and $46b per year between now and 2050.

- Provide the fiscal position for government to undertake other forms of tax reform, payments to assist with cost-of-living pressures, and to invest in the industries of the future where Australia enjoys a comparative advantage.

Summary of positions on three areas of focus for the Roundtable

Existing policies (4)

A complex matrix of discretionary policies creates inefficiencies in administration and investment uncertainty. Government driven, not market driven.

Inefficiently addressing emissions reduction creates trade offs that hurt productivity in other areas.

Effects of climate change reduce productivity.

Carbon pricing (5)

Simplicity and predictability of a carbon pricing mechanism is administratively simpler and efficient, and can create the right market signals for investment which can be productivity enhancing.

Most efficient way to decarbonise and for Australia to play its role in limiting the effects of climate change.

Existing policies

Fall short of creating the right market incentives to transition Australia’s economy away from fossil-fuel reliance to sustainable zero carbon industries.

Carbon pricing

Sends an efficient signal so markets can develop and investments can occur in zero carbon industries which can be a future source of economic prosperity,

Existing policies

At best, budget neutral (e.g. the safeguard mechanism) and at worst budget negative (e.g. CIS, necessary support for green industries).

Carbon pricing

Can generate substantial and sustained revenues worth between $18-46b per year annually.