In a landmark report released today, The Superpower Institute has proposed two policies to ensure polluting companies pay for the damage they cause, and that gas companies pay their share of tax to boost Australia’s prosperity and ensure cost-of-living relief to Australians.

Australia faces significant challenges to its long-term economic prosperity and environmental sustainability: its current policies to reduce carbon emissions are inefficient and we are not on track to meet our targets; our economic fundamentals are weak; and we face a structural budget deficit which prevents funding for a wide range of important policy needs including productivity-enhancing reform and cost-of-living relief for households.

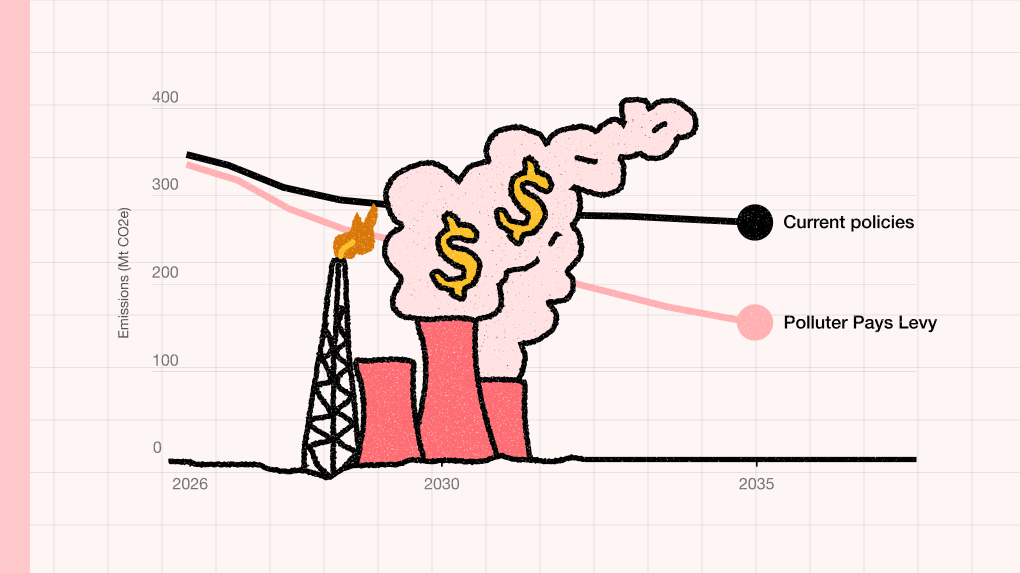

All these challenges can be addressed with two new policies: the Polluter Pays Levy (PPL), which is a levy on companies that extract or import fossil fuels that are consumed in Australia and the Fair Share Levy (FSL), which is a Norway-style tax on the cashflow of Australian gas producers.

Together the levies would collect an average revenue of about $35 billion each year between 2026 and 2050. Part of the revenue should be used to generously compensate households for higher energy and fuel prices and, in addition, we propose a support package starting at $490 per annum for all but the most well-off households. This represents significant cost-of-living relief. Even with compensation payments to households, the combined revenues leave more than $30 billion per year for strengthening the budget, investing in green industries where Australia has a comparative advantage, extra spending on social and other policies, and appropriate tax reform.

The PPL is based on the logic of ‘polluter pays’ and works to reduce emissions by levelling the playing field between products that pollute and those that do not. It would apply to around 140 Australian oil, gas, and coal extraction sites, operated by fewer than 60 companies. It would also apply to imported oil, petrol, and diesel. Together these account for roughly 80 per cent of Australia’s emissions.

The FSL will ensure gas companies in Australia pay their fair share of tax for extracting the gas resources that belong to all Australians. It is an economically neutral tax that does not affect future investment returns or export prices and has strong international precedent. Currently Australian state and federal governments take approximately 30 per cent of fossil fuel companies’ profits, through a combination of the corporate tax, royalties, and the Petroleum Resource Rent Tax (PRRT). But other major fossil fuel exporting countries take much more—typically between 75 and 90 per cent.

The FSL would replace the PRRT, and lift Australia closer to international practice at just under a 60% total tax level.

An FSL would increase government revenues by $13 billion a year on average from 2026-2050. These revenues would further strengthen the budget and support public investments in future prosperity. At its peak, benefits from the FSL are equivalent to about $1,540 per household. All Australians should benefit from our gas resources — not solely fossil fuel companies.

Research commissioned by TSI and undertaken by Redbridge Group confirms a strong public mandate for this package.

The study of 3,003 voters found that 68 per cent of Australians agree or strongly agree with introducing a 'Polluter Levy' on Australia's biggest emitters of greenhouse gases, with only 18 per cent disagreeing.

Furthermore, support for ensuring Australians receive a fair return on their resources is overwhelming: 87 per cent of voters agree or strongly agree that Australians deserve a better return from the sale of our gas exports, with just 3 per cent disagreeing.

Rod Sims, Chair of The Superpower Institute said: "The biggest polluters should pay for the pollution they cause. We’re proposing a simple levy that would apply to fossil fuel imports, and about 60 companies extracting coal, gas, and oil in Australia. These products are responsible for about 80 per cent of Australia’s emissions, but ordinary Australians are picking up the tab.

"It's a simple principle: if you cause the damage, you should help fix it. That's not radical, it’s fair.

Australia faces three choices: miss our emission reduction targets, meet them in ways that increase costs to consumers, or let the polluters pay for the damage they cause to our environment. The choice is obvious.

“Australians are ready for this. And if it’s designed properly, the revenue it raises can be returned to households to provide significant cost-of-living relief, while still leaving billions to strengthen the economy through tax reform, to develop housing, deliver social policies and invest in the low carbon industries of the future.“

Co-founder and Director of the Superpower Institute, Professor Ross Garnaut said: “For those naysayers who say this is politically impossible, I would simply remind them that Australia used to be a high tariff country up until the early 1980s. Then Labor Prime Minister Bob Hawke saw what was in the best interests of our economy and worked to remove them.

“Hard political decisions have been made before. In fact, these are often the best economic decisions.

“A Polluter Pays Levy and a Fair Share Levy are the most effective ways to both lower emissions and create a structurally robust Australian economy into the future. By international standards Australians are missing out on the economic benefits of our gas industry and we are in fact the ones subsidising their environmental degradation.

“This must change.

“We now all know that reducing tariffs substantially increased living standards of working Australians. That Hawke reform never had anywhere near as much public support in opinion polls as the PPL and FSL have now.”

CEO of the Superpower Institute, Baethan Mullen said: “Australia's oil, gas and coal belong to all Australians. But right now, we're letting companies extract these resources while paying some of the lowest taxes in the developed world.

"Norway taxes its oil and gas at around 78 per cent, while remaining an attractive destination for investment. They now have a $1.7 trillion sovereign wealth fund that benefits every Norwegian. Australia could do the same.

“Australia needs new and better policies to reduce its carbon emissions. It needs a stronger budget. And it needs to achieve these goals urgently and as efficiently as possible, to lift productivity and protect Australians’ welfare.