Thank you to the Department, to Austrade and to our Japanese hosts of the World Expo for the opportunity to be here today.

My focus today is to set the scene by explaining the opportunity in green metals trade that sits before us.

Japan and Australia have a rich history in trade relations, built on the foundational Agreement on Commerce signed in 1957.

The trade of the 1950s, from Australia to Japan, was built on raw materials - coal, iron ore, wool, beef, and wheat. Since then, it has been a prosperous and mutually beneficial relationship.

The green metals opportunity is an evolution, not a revolution, of this relationship. It has many of the same ingredients, applied in a new trade, technological and environmental paradigm.

Economies of the mid-20th century needed raw materials in the form of coal and iron ore to produce the steel to build the infrastructure and skyscrapers that would be the engine rooms of productivity well into the 21st century. Australia was a willing provider of these raw materials and over 60 years has built expertise in the mining and trade of raw commodities, including fossil fuel based energy.

But the world of the 1950s also faced no carbon emissions constraint, or at least it not knowingly.

Fast forward to 2025. The world still needs steel and the raw inputs to make it. Developing economies need steel as they modernise their cities and economies. Modern industrial economies continue to grow. Alongside continued expansion of infrastructure and growth of our cities we have new technologies that continue to drive the need for metals.

To provide one example, take passenger transport vehicles.

In the 1950s a typical passenger vehicle contained 8-10 types of metal. Steel was 70–75% of the weight of the car. The engine block was cast iron. It had copper wiring, a lead battery and small amounts of aluminium, brass, zinc, tin, chromium, nickel and magnesium.

A modern electric vehicle is of course quite different, obviously through the inclusion of a battery. But the car also needs to be much lighter. Steel makes up only 45-55% of the weight of an EV, with the inclusion, most notably, of more aluminium to make it lighter. An EV has around 300kg more aluminium than the 1950s car.

Then there is the battery itself which for an EV is about 20-25% of the weight of the car. The battery contains metals that had no place in the 1950s car - graphite, manganese, cobalt, lithium and other rare earth metals.

So while the need for steel remains, the growing need for a broader variety of other types of metals has emerged.

So can Australia fulfil a role here?

Australia is a large producer of lithium and has reserves of cobalt, nickel and manganese. These are mostly refined offshore at present but this could change over time.

And electric vehicles are just one example. Future trade in all products requiring metals will be driven by similar changing needs.

It is important to understand the underlying logic for green metals production and trade.

As I said earlier, the industrialisation that took place in the mid-20th century did so without regard to the impact we were imposing on our climate.

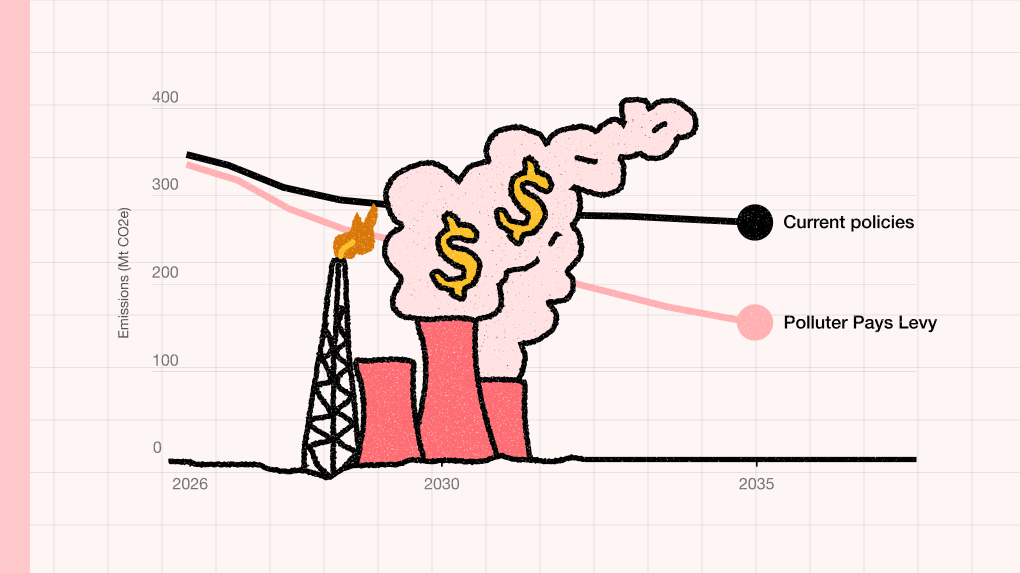

The imperative to reduce emissions is well recognised. Most countries have made commitments to reach net zero. These commitments now require policies and actions that will drive us towards those targets.

Steelmaking and aluminium refining together account for around 10% of global emissions.

In the case of steel, blast furnace technology is very carbon intensive. If we are to achieve the world’s net zero goals we will need to decarbonise this production method. I will return to steel in more detail shortly.

For any industrial process that uses fossil fuels, and which creates emissions that contribute to global warming, we now face pressure to find alternatives.

Conceptually, there are two pathways.

We could, in theory, simply replace fossil fuel use with zero carbon energy, and then continue industrial activity in the places where it occurs now in much the same way.

However, analysis by The Superpower Institute has identified three main challenges.

First, not all countries are capable of producing enough cheap, zero carbon energy, particularly from renewable energy. Japan is an example of a country that is constrained by land mass, weather and geography. In a net zero world Japan will need to import zero carbon energy.

Second, transportation of zero carbon energy is much more expensive than transportation of fossil fuels. High voltage transmission, particularly by undersea cable, is exepensive and faces practical challenges. Production of hydrogen is relatively expensive (compared with coal, oil and gas) and its transportation results in large efficiency losses.

Third, countries that are in short supply of zero carbon energy will be at a competitive disadvantage to countries that can produce this energy cheaply and abundantly themselves. This will be destructive to their downstream industries and the wellbeing of their people.

Japan is an example of a country that is constrained by land mass, weather and geography. In a net zero world Japan will need to import zero carbon energy.

These facts lead to the conclusion that trade in zero carbon energy will occur differently to fossil fuel energy trade. Economics will drive energy production to the lowest cost sources of supply. It will be generated AND used close to the source of production to add value to commodities. Those commodities can then be transported at relatively low cost, with energy embedded in them, to demand centres where low cost zero carbon energy is in short supply.

The best example for this will be green iron. Australia has the world's largest deposits of iron ore and world-class renewable energy capacity. Australia also has low domestic demand relative its capacity to produce. Combining these factors, we can produce green iron and ship it to steelmaking countries around the world.

This has two very large benefits to the trading countries involved.

It meets the objective of decarbonising the production of metal, by using energy from a low cost source where energy is abundant.

And it also preserves and grows economic activity. Existing steel producers can continue to produce steel and to supply this to downstream customers like car makers, whitegoods manufacturers and technology companies.

Imports of coal, oil and gas are replaced, over time, with imports of low and zero carbon commodities. Countries that import value added products like cars, like Australia, continue to do so. And all while meeting our net zero goals.

Green iron as an input to green steel is just one, if very important, example. There will be demand for green aluminium, copper, silicon and polysilicon and rare earth metals.

The same economic logic will also apply to green fuel manufacturing which will facilitate the low carbon transportation of green metals around the world.

To sum up: this is a time when Australia and Japan can look forward to a continuing and prosperous trade relationship built on the back of decades or strong partnership and a bright future through trade in green metals. Thank you.

Baethan Mullen

Chief Executive Officer

Baethan Mullen has over 20 years of experience in public policy, economics and advocacy. Prior to joining the Superpower Institute, Baethan was General Manager of Economics & International at the ACCC, and led the largest energy efficiency program in Australia as Executive Director at the Essential Services Commission.